Becoming a Certified Financial Analyst (CFA) is a significant career move that opens doors to various roles in the financial sector, such as investment banking, portfolio management, corporate finance, and more.

While the official CFA certification is awarded by the CFA Institute after passing a series of challenging exams, many candidates use online courses to help them prepare.

Udemy is one of the most popular online learning platforms, offering a variety of courses that can help you on your CFA journey. But how do you know which courses are worth your time?

This guide will walk you through the steps to becoming a financial analyst and how Udemy can be an essential tool in your preparation.

Udemy

Udemy is a popular online learning platform that offers a vast range of courses across various fields, including finance, technology, personal development, and more.

With over 155,000 courses taught by industry experts, Udemy provides affordable and flexible learning opportunities for students worldwide.

Whether you’re looking to advance your career, pick up new skills, or dive into a new hobby, Udemy’s self-paced courses are designed to cater to all learning styles.

Students on Udemy can access video lectures, downloadable resources, quizzes, and assignments, with lifetime access to course materials after purchase.

This makes it convenient for learners to study at their own pace, on their own schedule, from anywhere with internet access.

Courses on Udemy range from beginner to advanced levels, and many offer certifications upon completion.

What sets Udemy apart is its affordability, especially during sales, where courses can be purchased for as low as $10.

It also offers a wide variety of professional certifications, including CFA exam prep courses, financial modeling, and programming.

With its broad course catalog, Udemy is an excellent resource for anyone looking to gain practical knowledge and skills without the high cost of traditional education.

What Does it Mean to Be a Certified Financial Analyst?

The Role of a CFA

The CFA credential is one of the most respected designations in the financial world. The CFA program is designed for professionals who want to deepen their expertise in areas such as investment analysis, portfolio management, financial reporting, and corporate finance.

To earn this certification, candidates must pass three levels of exams that test a wide range of financial topics, all while adhering to a strict code of ethics and professional standards.

CFA candidates are expected to have at least four years of relevant work experience, which ensures that certified professionals not only possess technical knowledge but also have practical experience in the field.

It’s important to note that becoming a CFA involves much more than simply passing exams—it also demands a high level of dedication and commitment.

The Three Levels of the CFA Exam

The CFA exams are divided into three levels, each with its own unique focus:

- Level I focuses on basic knowledge and tools needed for financial analysis. This includes topics like ethics, financial reporting, and quantitative methods. The exams at this level consist mostly of multiple-choice questions.

- Level II builds on the foundation established in Level I. It delves deeper into asset valuation, corporate finance, and financial modeling. The format shifts to a combination of multiple-choice questions and vignette-style questions that require more analytical thinking.

- Level III is the final level, focusing on portfolio management and wealth planning. This level requires candidates to apply everything they’ve learned to real-world scenarios. It also includes essay-style questions, which test the candidate’s ability to think critically and communicate solutions effectively.

Why Use Udemy to Prepare for the CFA Exam?

While the official CFA Institute offers study materials and resources, many candidates prefer to supplement their study plans with online courses. Udemy is an excellent option for CFA exam preparation for several reasons:

1. Affordable and Accessible

Udemy is often more affordable compared to traditional CFA exam preparation providers, especially during sales.

You can often find courses for as low as $10–$20, making it a budget-friendly option for those who want to study without breaking the bank.

2. Flexible Learning Pace

Udemy allows you to learn at your own pace. Whether you’re juggling a full-time job or simply prefer to study during your free time, Udemy gives you the flexibility to learn when and where it’s convenient for you. The courses are self-paced, so you can stop and start whenever necessary.

3. Comprehensive Coverage

Udemy offers a wide variety of courses tailored to different aspects of the CFA exam. Some are general prep courses that cover all three levels of the CFA exam, while others are more focused on specific subjects like financial modeling, equity analysis, or portfolio management.

4. Lifetime Access

Once you purchase a course on Udemy, you get lifetime access to the materials. This means that you can revisit lessons anytime you need to refresh your knowledge or review for the exam.

5. Real-World Skills

Besides CFA exam prep, Udemy also offers courses that teach practical skills for financial analysts. Courses in Excel, financial modeling, accounting, and business analysis can help you develop the hands-on skills needed for a successful career in finance.

Step 1: Understand the CFA Exam Structure

Before diving into Udemy courses, it’s crucial to understand the CFA exam structure. This will help you prioritize the topics you need to focus on and choose the right courses.

The Three Levels

The CFA program consists of three levels, each progressively more difficult than the last. Here’s a breakdown of the key focus areas for each level:

Level I: This level tests your foundational knowledge of financial concepts. You’ll need to understand the core concepts and the ethical framework for finance professionals. Topics include:

- Ethics and Professional Standards

- Quantitative Methods (statistics, time value of money)

- Financial Reporting and Analysis

- Economics

- Corporate Finance

Level II: At this level, the focus shifts to applying the concepts learned in Level I to more complex financial situations.

You’ll need to demonstrate your ability to analyze financial statements, value assets, and assess risk. Topics include:

- Equity Investments

- Fixed Income

- Derivatives

- Financial Reporting and Analysis (deeper dive)

- Corporate Finance

Level III: The final level emphasizes portfolio management and wealth planning. You’ll need to apply your knowledge to create investment strategies for clients.

The format includes both multiple-choice questions and essay-style questions. Topics include:

- Portfolio Management and Wealth Planning

- Alternative Investments

- Risk Management

- Ethical and Professional Standards (emphasis on application)

Exam Timeline and Commitment

Each level of the CFA exam requires significant study time. On average, candidates spend around 300 hours preparing for each exam level.

The exams are offered twice a year for Level I and once a year for Levels II and III. You’ll need to plan your study schedule around these timelines to ensure you’re well-prepared.

Step 2: Choosing the Right Courses on Udemy

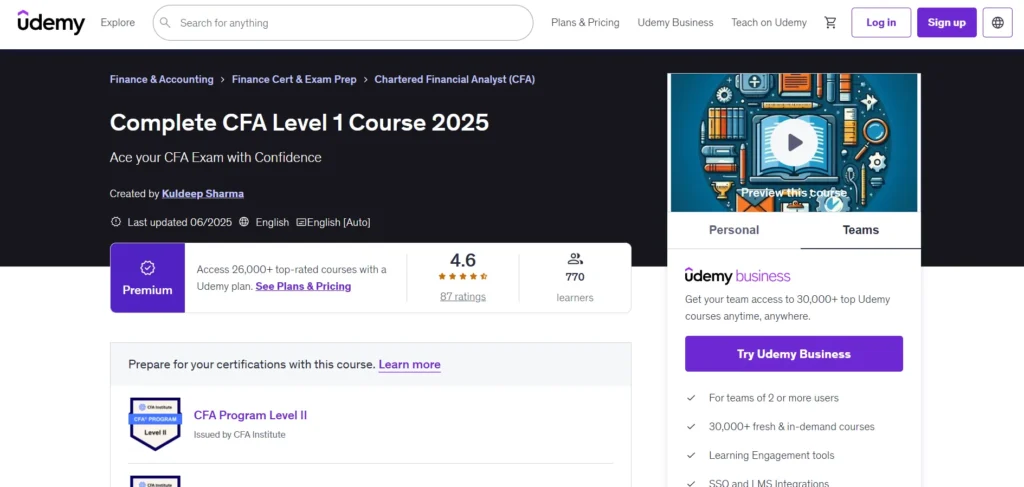

Udemy offers a wide variety of courses designed to help you prepare for the CFA exams. Here are some of the best courses you can find on the platform:

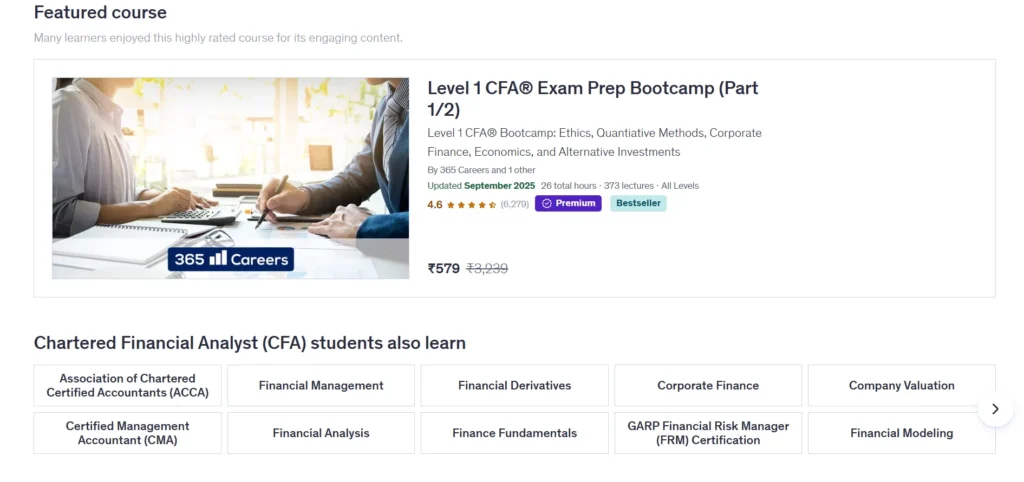

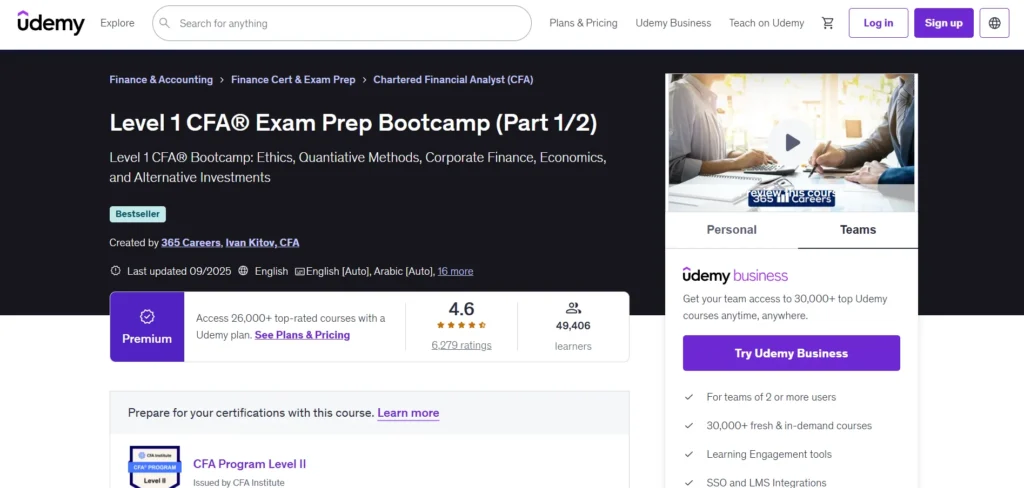

CFA Exam Prep Courses

Udemy offers CFA exam prep courses for each level of the exam. These courses provide comprehensive coverage of the CFA curriculum, including lectures, practice questions, and study materials. Some of the top courses include:

- CFA Level I Exam Prep Bootcamp: This course covers all the key topics of Level I, including ethics, quantitative methods, financial reporting, and more. It includes over 20 hours of video content and practice exams to help you gauge your progress.

- CFA Level II Exam Prep: This course focuses on the more advanced topics of Level II, such as asset valuation and financial modeling. It includes in-depth video lectures, problem sets, and mock exams.

- CFA Level III Exam Prep: The final level can be the most challenging, and this course provides focused lessons on portfolio management and wealth planning. It includes essay-style questions and tips for answering them effectively.

Specialized CFA Topic Courses

In addition to the general prep courses, Udemy also offers specialized courses for specific topics within the CFA curriculum.

For example, if you find that you struggle with financial reporting, you can take a course that focuses solely on this area. Some popular specialized courses include:

- CFA Level I Financial Reporting and Analysis

- CFA Level II Equity Investments

- CFA Level II Fixed Income

These courses can be particularly helpful if you need extra help in certain areas or want to dive deeper into a specific subject.

Practical Financial Analyst Courses

Udemy also offers practical courses for those who want to develop skills that go beyond the CFA exams.

These courses are ideal for financial analysts looking to improve their abilities in real-world scenarios. Some examples include:

- Financial Modeling for Beginners

- Excel for Financial Analysis

- Business Valuation Fundamentals

These courses focus on building the skills that employers look for in financial analysts, such as financial modeling, data analysis, and business valuation.

Step 3: Evaluating Course Quality

While Udemy offers many valuable courses, the quality of the courses can vary. It’s essential to evaluate each course before committing to it. Here are some tips on what to look for when choosing a course:

1. Course Reviews and Ratings

Udemy courses have user reviews and ratings, which can give you a good idea of the course quality. Look for courses with high ratings (4 stars and above) and read through the reviews to see what other students have said.

Pay attention to comments about the course content, the instructor’s teaching style, and whether the course aligns with the CFA exam syllabus.

2. Course Content and Structure

Make sure the course content covers all the topics in the CFA curriculum. Look for courses that provide clear outlines, practice questions, and detailed explanations.

Courses that include quizzes, assignments, and mock exams are especially helpful for testing your knowledge and reinforcing what you’ve learned.

3. Instructor Experience

Check the credentials of the course instructor. Look for instructors who have experience in the finance industry, preferably with a CFA certification or a background in teaching financial analysis. Experienced instructors can offer valuable insights and practical tips for passing the exams.

Step 4: Study Tips for Success

Taking a course on Udemy is just the first step. To maximize your chances of success, it’s important to adopt effective study strategies:

1. Create a Study Schedule

Set aside dedicated time each day or week to study. Creating a study schedule will help you stay on track and ensure that you cover all the necessary topics.

Stick to your schedule as closely as possible, but be flexible if you need more time on certain subjects.

2. Take Notes

While watching lectures, take notes to reinforce what you’ve learned. Writing things down helps you retain information better and gives you a reference to revisit later.

3. Practice, Practice, Practice

Financial analysis requires hands-on practice. Make sure to complete all the exercises, quizzes, and mock exams included in the Udemy courses.

Practice problems will help you apply what you’ve learned and improve your problem-solving skills.

4. Join Study Groups

Consider joining a study group or forum where you can interact with other CFA candidates. Discussing difficult topics and sharing study strategies can help you stay motivated and gain new insights.

5. Take Breaks

Studying for the CFA exams can be mentally exhausting. Make sure to take regular breaks to rest and recharge. A well-rested mind is more productive and better equipped to retain information.

Conclusion

Becoming a Certified Financial Analyst is a challenging but rewarding path. While Udemy courses cannot provide you with the official CFA certification, they can certainly help you prepare for the exams and build the necessary skills for a successful career in finance.

By choosing the right courses, developing a solid study plan, and staying committed, you can increase your chances of passing the CFA exams and achieving your career goals.

Remember, Udemy offers flexibility and affordability, making it an excellent resource for those looking to gain financial analysis expertise.

But as with any learning platform, it’s essential to choose quality courses and use them as part of a well-rounded study strategy. Good luck on your journey to becoming a CFA!

FAQs

What is Udemy?

Udemy is an online learning platform offering affordable, self-paced courses on various topics, taught by industry professionals.

Can I get certified on Udemy?

Udemy offers certificates of completion for many courses, but they are not official professional certifications like the CFA.

How long do I have access to Udemy courses?

Once you purchase a course on Udemy, you have lifetime access to its materials.

Are Udemy courses suitable for beginners?

Yes, Udemy offers courses for all skill levels, from beginner to advanced.

Can I study at my own pace on Udemy?

Absolutely! Udemy courses are self-paced, allowing you to learn whenever and wherever you prefer.